Who we are

Our address:

_______________________

roni@techtime.co.il

techtime.news

What personal data we collect and why we collect it

We collect anonymous data on visitors in this website for business purposes such as enhancing user experience, digital marketing and search engine optimization.

We collect personal data such as email address and names on various forms - all forms present in this website include consent checkboxes and clear reason for collecting the data: general inquiries on our products, newsletter subscription, professional inquiries job applications. All forms are designed in accordance with GDPR requirements.

Comments

When visitors leave comments on the site we collect the data shown in the comments form, and also the visitor’s IP address and browser user agent string to help spam detection.

An anonymized string created from your email address (also called a hash) may be provided to the Gravatar service to see if you are using it. The Gravatar service privacy policy is available here: https://automattic.com/privacy/. After approval of your comment, your profile picture is visible to the public in the context of your comment.

Media

If you upload images to the website, you should avoid uploading images with embedded location data (EXIF GPS) included. Visitors to the website can download and extract any location data from images on the website.

Contact forms and newsletter

We use Gravity Forms as our platform of choice for all forms present in this website. Forms present in this website have been modified to fit GDPR requirements.

Unless specifically specified and approved by visitor, we do not use the collected data for marketing purposes.

We use Mailchimp to collect email addresses and send periodical marketing materials to our customers.

Handling and management of all email addresses and mailing operations is conducted under GDPR terms and guidelines provided by Mailchimp.

All subscribers are able to change their subscriptions preferences or unsubscribe at any given time.

Techtime has accepted the Data Processing Addendum agreement provided by Mailchimp for all its Mailchimp accounts.

All our lead collection forms have been altered in accordance with GDPR requirements and now include unchecked checkboxes in order to accept the explicit consent of the user prior to form submission.

Cookies

If you leave a comment on our site you may opt-in to saving your name, email address and website in cookies. These are for your convenience so that you do not have to fill in your details again when you leave another comment. These cookies will last for one year.

If you have an account and you log in to this site, we will set a temporary cookie to determine if your browser accepts cookies. This cookie contains no personal data and is discarded when you close your browser.

When you log in, we will also set up several cookies to save your login information and your screen display choices. Login cookies last for two days, and screen options cookies last for a year. If you select "Remember Me", your login will persist for two weeks. If you log out of your account, the login cookies will be removed.

If you edit or publish an article, an additional cookie will be saved in your browser. This cookie includes no personal data and simply indicates the post ID of the article you just edited. It expires after 1 day.

Embedded content from other websites

Articles on this site may include embedded content (e.g. videos, images, articles, etc.). Embedded content from other websites behaves in the exact same way as if the visitor has visited the other website.

These websites may collect data about you, use cookies, embed additional third-party tracking, and monitor your interaction with that embedded content, including tracing your interaction with the embedded content if you have an account and are logged in to that website.

Analytics

We use Google Analytics regularly for monitoring user behavior and traffic sources and utilize the gathered information for enhancing user experience and for business purposes.

The use of Google Analytics in done according to GDPR terms and guidelines provided by Google.

Legal Entity: Techtime.

Primary Contact (a.k.a. "Notification Email Address"): roni@techtime.co.il - this email is designated for receiving notices under the Google Ads Data Processing Terms.

Who we share your data with

We use various cloud platforms and third party providers for the purpose of operating this website.

We do not share or sell your data for any commercial purpose other than specified above.

We use the following processors for the operating this website and executing related digital marketing campaigns:

- WP Engine - Hosting Provider

- Cloudflare - Cloud based security and web performance processor.

- Google Cloud Platform - data centers provider for WP Engine

- Sucuri - Website security provider

- Mailchimp - Newsletter service provider

- Google Analytics, Adwords, Webmasters

- Facebook - We use Facebook for advertising and place tracking code on our website for enhancing digital marketing campaigns (i.e - Facebook Pixel).

- Planwize Ltd - Digital Marketing Agency.

How long we retain your data

If you leave a comment, the comment and its metadata are retained indefinitely. This is so we can recognize and approve any follow-up comments automatically instead of holding them in a moderation queue.

For users that register on our website (if any), we also store the personal information they provide in their user profile. All users can see, edit, or delete their personal information at any time (except they cannot change their username). Website administrators can also see and edit that information.

What rights you have over your data

If you have an account on this site, or have left comments, you can request to receive an exported file of the personal data we hold about you, including any data you have provided to us. You can also request that we anonymize or erase any personal data we hold about you. This does not include any data we are obliged to keep for administrative, legal, or security purposes.

Request for Receiving Data Associated with One’s Email Address

Users may request to receive access to all related information submitted to this website for their review.

In accordance with GDPR compliance, user may further request the anonymization of such data.

In order to request access for all data associated with a given email address, users may submit the request

here. Users then receive an email with a link to a page with all related information.

The link is valid for 24 hours. Users may submit additional request for the same email address once in every 24 hours.

A request for anonymization should be sent separately: User may select the data he or she wishes the site owner to anonymize so it cannot be linked to his or her email address any longer. An email confirmation will be sent once linked data has been successfully anonymized.

Where we send your data

Visitor comments may be checked through an automated spam detection service. All our processors and third party providers comply with GDPR requirements and apply privacy by design and necessary measure to ensure that personal data is being processed and handled in accordance with requirements. The list of our third party service providers and processors is listed above.

Contact information

For all privacy-specific concerns inquiries, you may contact us at mail@mail.com

How we protect your data

We use rigorous practices in order to protect our website and data collected, as well as world class cloud and hosting providers.

Communication between visitor and the server is encrypted using SSL.

The site is protected with web application firewall and is undergoing daily security scans, regular software updates by a dedicated team in order to minimize the risk of data breach.

What data breach procedures we have in place

Once a data breach is detected, our providers execute a dedicated standard operational procedure in order to assess the scope and potential damage, provide immediate remedy, patch any potential security holes and notify users who may be affected by the breach.

We may contact affected users with one or more form of communication within 72 hours and provide the needed information as to the scope of the data breach and actions taken.

What third parties we receive data from

We do not receive data from third parties for our marketing campaigns.

What automated decision making and/or profiling we do with user data

We may apply remarketing/retargeting methods while conducting online advertising using Google Facebook and the likes.

The above is conducted by applying various tracking codes into our website in order to track and retarget users based on

By visiting and using this website you are hereby provide your consent for the use of the above means and methods.

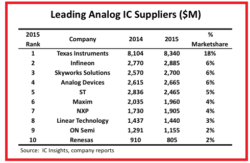

A report by leading research group IC Insights shows that Texas Instruments continues to lead the analog components market. In 2015, TI’s market share was estimated to be an impressive 18% or $47 billion. TI’s leading position becomes all the more clear when considering that TI sells more components than the three next listings in the leading analog IC suppliers put together. According to IC Insights, Texas Instruments is able to maintain its lead in the analog market thanks to its long term strategy rooted in its 2009 decision.

A report by leading research group IC Insights shows that Texas Instruments continues to lead the analog components market. In 2015, TI’s market share was estimated to be an impressive 18% or $47 billion. TI’s leading position becomes all the more clear when considering that TI sells more components than the three next listings in the leading analog IC suppliers put together. According to IC Insights, Texas Instruments is able to maintain its lead in the analog market thanks to its long term strategy rooted in its 2009 decision.